Model Validation

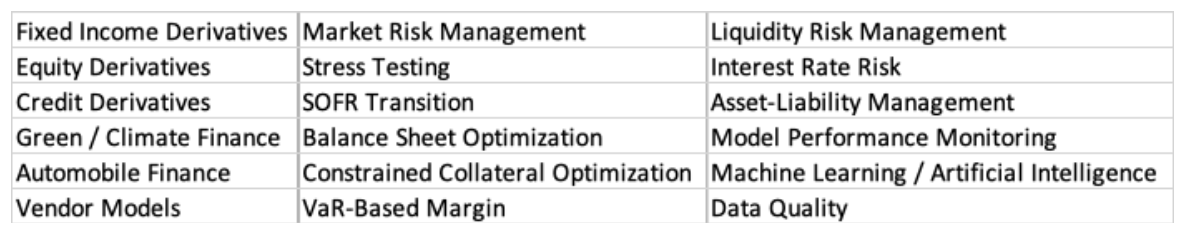

The Martingale Solution Group’s approach to model validation leverages its experience in model risk management, as well as its background in profit-driven model ownership, to achieve effective and balanced model validation outcomes. Martingale employs industry best practices to deliver value-adding model risk reviews of business decision tools and risk management models. Martingale Solution Group can execute the client’s model validation framework or create policies / procedures / workflows that are efficient and aligned with regulatory expectations.

Model validation involves a quantitative assessment of model inputs, outputs, modeling methodology, performance monitoring and suitability for business purpose. The Martingale approach complies with the model risk regulatory guidance in OCC Bulletin 2011-12 / FRB SR Letter 11-7 / FIL-22-2017. Martingale Solution Group’s model validation experience spans the Federal Reserve Bank of New York, investment banks and the insurance industry.

Strategic Regulatory Compliance

Martingale Solution Group can execute the client’s regulatory compliance activities and develop strategies and plans to effectively remediate issues for long-term process optimization. Both fintech startups and established banks/credit unions can benefit from the Martingale approach. Martingale can leverage its background in Federal Reserve System stress-testing model development / execution / reviews well as its model ownership experience at money-center banks, to effectively set client firms on the right path to remediate regulatory findings. Martingale can work with client firms to build control frameworks that satisfy statutory and internal audit requirements. Improve your control outcomes – reach out to Martingale Solution Group today to get on the straight path to compliance.